Data: Zombie VC Firms Walk Among Us

A new study by Carta shows that later-cycle funds raised in 2021 and 2022 have dramatically slowed down their investment pace. Here's what it means for startups.

The Upshot

Venture capital is still a relationships game. For startup founders, finding the right person to back your business is still the most important part of fundraising (besides the cash).

But startups can save themselves a lot of time, and potential headache, by turning the tables a bit. The key question: Is this VC firm a walking zombie?

The signs might not be obvious yet. Partners are still active at firms until they’re not, sometimes writing checks weeks before announcing a transition to part-time or ‘venture partner’. And with a few blockbuster exceptions, VC firms don’t typically blow up. Instead, they slowly, often quietly, peter out.

But there will be signs. New data shows that when a firm raised its fund — and how far along it is in the deployment cycle — could go a long way to determining whether you’re wasting your time.

Think of it as a loading progress bar, showing 60% or 80%. How far into a fund’s life cycle is that VC firm? How fast have they recently been writing checks?

And if the answer is that you’re looking to become one of the last investments for a fund raised three or four years ago, brace yourself.

New data from Carta (via its first Fund Economics Report) shows that funds raised in 2021 and 2022 have noticeably slowed down their investment pace, after running hot initially.

Funds closed in 2021 deployed faster in their first year, deploying 33% of their money compared to a more typical less than 20%, then applied the brakes: the median 2021 fund has still only deployed 88% of its capital, lower than any vintage of the previous four years.

It’s a similar story for funds raised in 2022. They’re currently 67% deployed, and at the three-year mark had deployed slower than the five previous years of funds.

What that means, according to Peter Walker, head of insights at Carta: firms still investing out of 2021 and 2022 funds — the exuberant zero interest rate, or ZIRP, era — are becoming much pickier (or skittish) as they reach the end of their fund lifecycles now.

“They’re approaching this fundraising market and finding it much chillier than they’d hoped,” Walker says. “They’re worried this might be the last time they get to invest.”

Founders talking to stalling firms face the following hurdles:

Added conversations and data requests

More intense due diligence

Slower decision processes

That’s not the situation with many newer funds: while 2023 vintages are tracking closer to 2022, funds raised in 2024 are tracking to deploy faster than historical norms, Carta found. AI-focused funds that have invested widely and quickly, and the blue-chip bigger firms with long track records are also notable exceptions.

One caveat: firms might have other, very good reasons to have slowed down their check-writing. Perhaps they don’t want to play a valuations game with AI enabled software, or macro factors are creating concerns in a specific sector of focus.

Another: many startups don’t have the luxury to turn away firms based on yellow flags like this. They need capital, and they have to take what they can get.

All things being equal, however, it makes sense for founders to add a couple of diligence questions back to their own VC calls:

What vintage fund are you deploying out of, and how far along is it?

What’s been your pace of deployment in the past year? Has it been consistent with previous years? (And if not, why?)

Do you anticipate raising another fund soon?

You won’t be able to spot all the zombies this way, but it can provide some peace of mind. Nobody wants to work with a fund that won’t answer the phone in a couple of years.

Other useful tidbits:

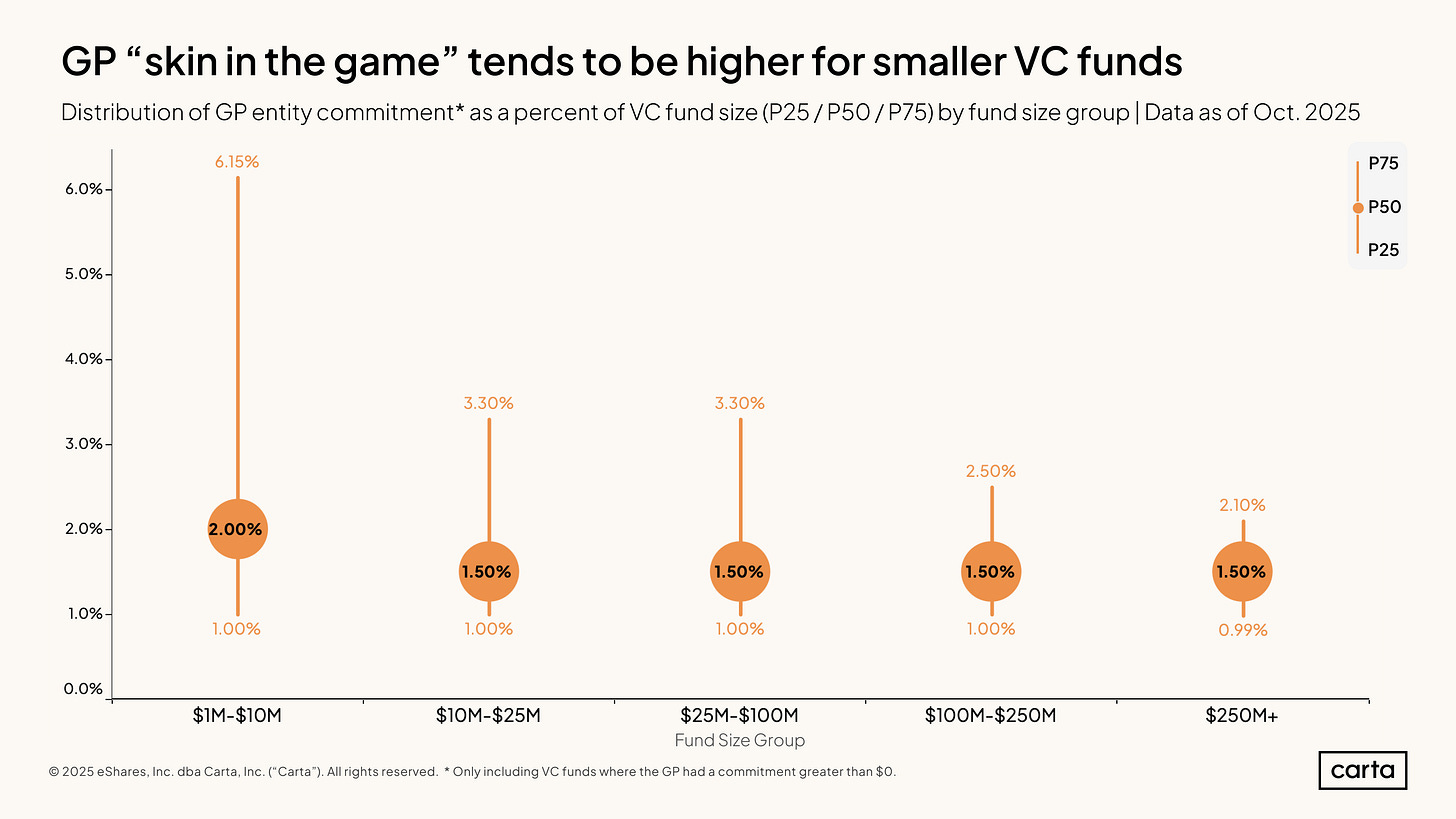

Skin in the game: Private equity managers, while not celebrated for their podcasts and lifestyles like VCs, tend to walk the walk with 50% more personal capital in their funds.

Emerging managers beware: Funds are raising fewer, larger LP checks, meaning it could be tougher to find an anchor.

Fund structures flat: Firms are still mostly adhering to a 2-and-20 structure with fees and carried interest, with 90% percentile micro funds ($10 million or smaller) and giga funds ($100 million or larger) showing the most appetite to raise their carry to 25% or 30%.

Want more analysis like this? Let us know in our annual Audience Survey!

It’s anonymous and crucial for us to bring you the right content, aligned with the right partners. (If you’re interested in sponsoring, you can check out our interest form.) As a year-one startup, we really appreciate your feedback.

Great read