Exclusive Data: Startups Are Learning What AI Profits Look Like

Gross margins for AI tools are rising, a new survey of 300 startups finds. But Google will be happier than Anthropic and OpenAI about which models they use.

They’re not yet a golden goose. But startups building AI products are starting to learn there’s more to life than just high-octane sales growth: healthy margins can be pretty good, too.

That’s great news for startups, their employees and investor backers, too. But it also means the bar for what ‘good’ looks like will keep going up.

The numbers in play here are new survey results from investment firm ICONIQ, which polled about 300 executives — mostly in the U.S. and with less than $100 million in revenue — last December as an update to research it published last June.

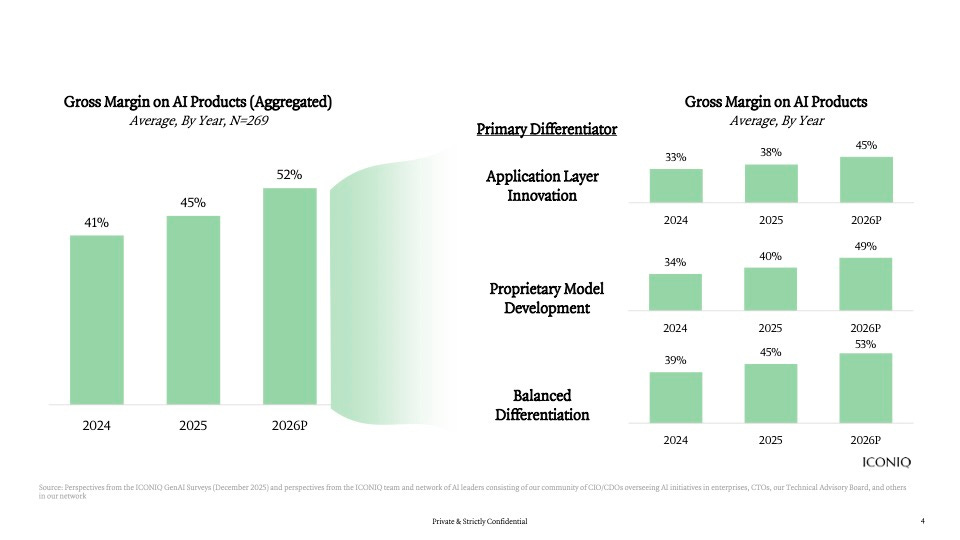

What they found: Gross margins are going up for AI products, from 41% in 2024 to 45% in 2025, and a projected 52% for 2026.

Narrowing our focus just to the application layer, where a lot of the tools you probably know and use, live, and those numbers don’t change much: margins of 33% in 2024 growing to 38% last year, with 45% projected for 2026.

Not someone who has to worry about margins and a little lost? We don’t blame you. Here’s why this matters:

Gross margin is a metric that measures the percentage of revenue a company keeps after factoring in its directly related costs to make it. And it’s been historically a major way to track the value of software businesses selling subscriptions, where the best startups can expect gross margins better than 80%.

AI startups like to boast about being the fastest ever to hit various revenue milestones, but profits are not where they usually shine. Models are costly to train and operate. And whether it’s through computing costs, or token use of those models, those costs get passed through to startups building on top.

But as they grow, and try to prove they can stick around — let alone test the public markets — companies building AI products need to figure out the profitability part.

“Companies are really starting to focus more on the gross margin impact of using AI,” says ICONIQ partner Vivian Guo, who worked on this report and the firm’s previous one in June.

The survey has some other interesting results, too. If you’re busy building, here’s our TL;DR of 3 other top findings:

Startups are using more models – and Google more than Anthropic

R&D is where startups use AI and spend the most – but not where startup leaders see the most value

Startups think AI won’t really reduce headcount — but we don’t buy it

We get into those results and a few more eye-opening findings below. You can read the full report here.

We’re publishing our first Upstarts Profile about one of the most important under-the-radar startups in Silicon Valley soon, and paid subscribers will see it first.

Can you guess which it is? We’ll gift a 3-month subscription to the first correct answer. No clue? Our January sale gives you 20% off for a limited time.

‘But why more models?’

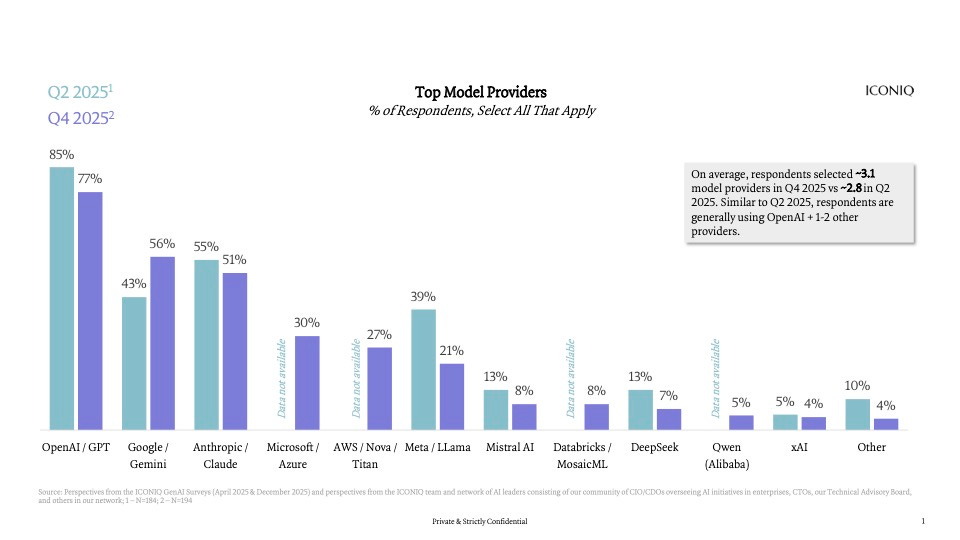

Startups are increasingly model polyamorous, increasing the number of models in their setup from an average of 2.8 to 3.1 over the past few months.

OpenAI is still a dominant first choice (although dropping). But Upstarts was surprised to see Anthropic giving up ground after them, and Google surging into second place.

The jump reinforces a narrative we’ve heard anecdotally around the ecosystem: that savvy companies are increasingly using OpenAI’s flagship models for heavier-lift use cases, but then opting for a cheaper, smaller model like Gemini Flash for higher volume stuff.

ICONIQ’s Guo agrees, saying her firm has heard similar buzz. Anthropic still fares better on the enterprise end of the spectrum, she adds.

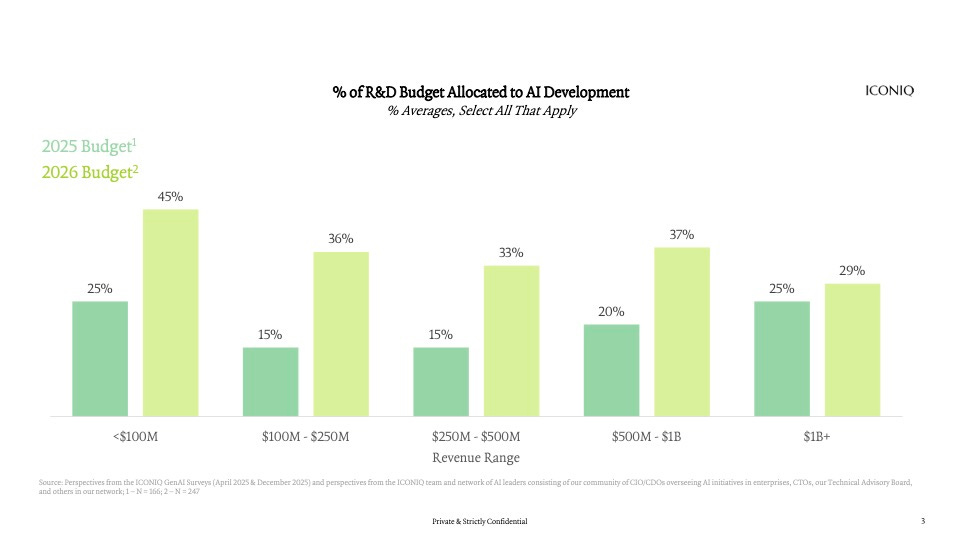

Budget hogs

It’s not surprising that earlier stage startups spend more of their R&D budgets on AI. But for all but the biggest, these are pretty significant increases in percentage of spend.

Subscription pricing under attack

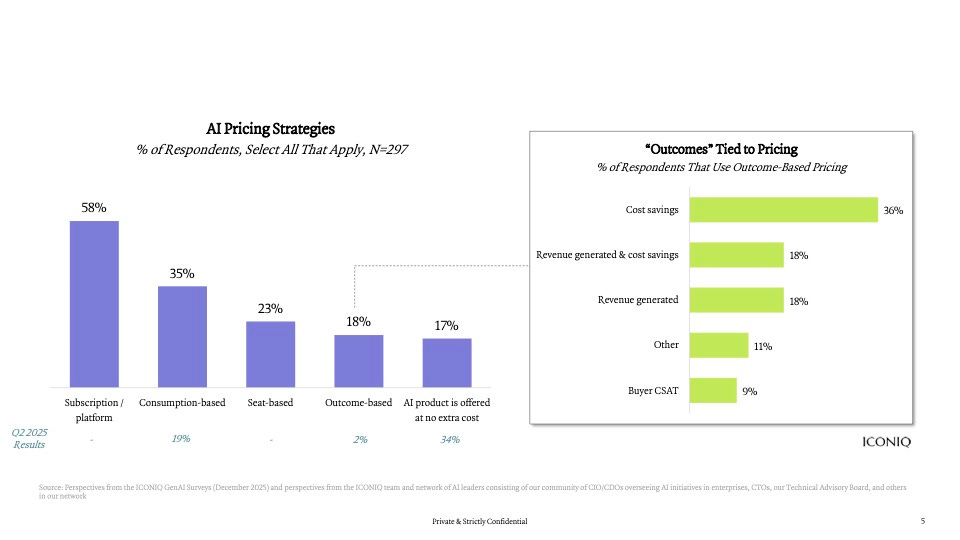

We’ve covered how some startup standouts like Cursor have explored hybrid pricing models to grow more efficiently and not get crushed by the cost of serving power users.

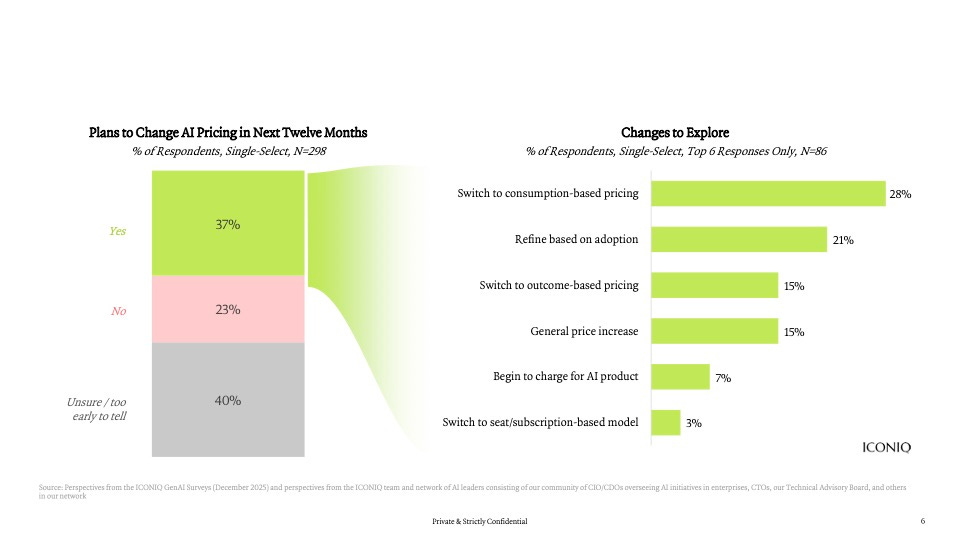

Subscription and per-seat models still rule among AI product builders, but you’re starting to see more interest in consumption and outcomes-based approaches.

That’s reflected in about 37% of the companies surveyed saying they plan to change their pricing structure over the next year, while 40% aren’t sure yet if they might. Our guess would be that few are going fully in the other direction, away from hybrid or consumption-based approaches.

Chasing the biggest gains

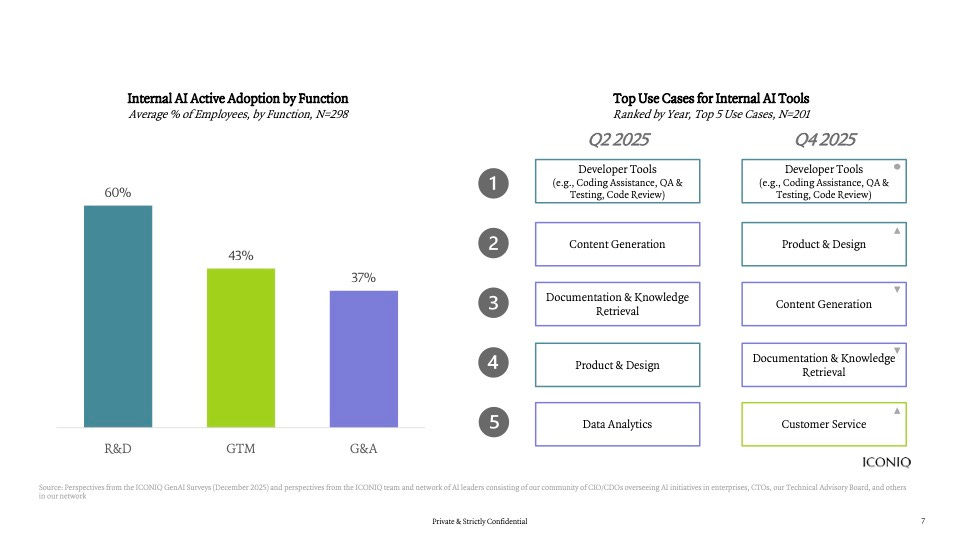

It will surprise no one, nobody at all, that coding and developer-related tools are where companies still see the top use case for AI tools.

Lower adoption among general and administrative functions like HR, finance and legal was more surprising to Guo, she says.

“There are more barriers to adoption, but given what we’re seeing with some of the application players, I would imagine that when we run the survey again in the next six months, those newer tools will make that go up.”

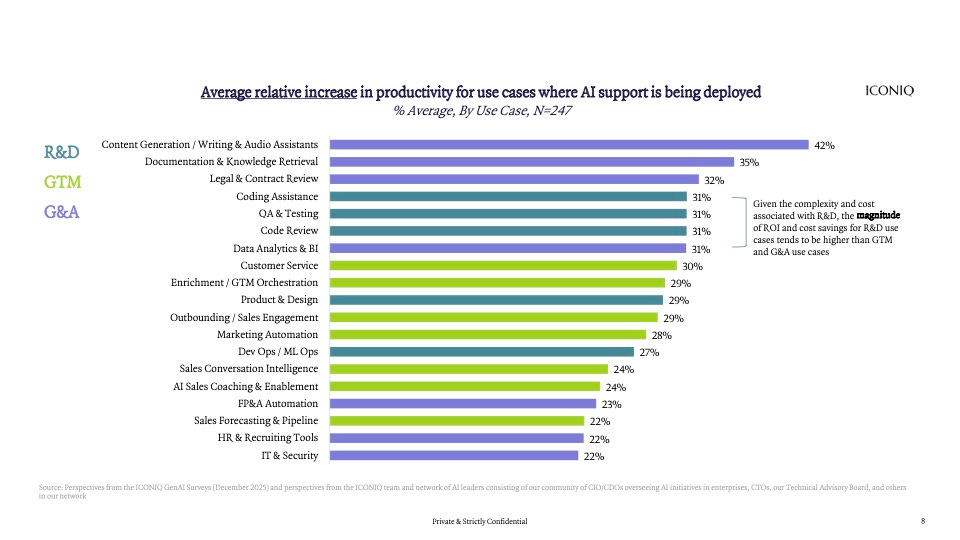

Another wrinkle: coding related use cases were not the places that startups self-reported they were seeing the biggest productivity gains.

Could there be a disconnect between what rank-and-file startup employees and their bosses think here? Guo says it’s something ICONIQ could try to break out in the future, as right now these estimates come from the top.

“The executive layer might have a very different perception of productivity versus the employees who are actually using the AI tools,” she says.

Human growing pains?

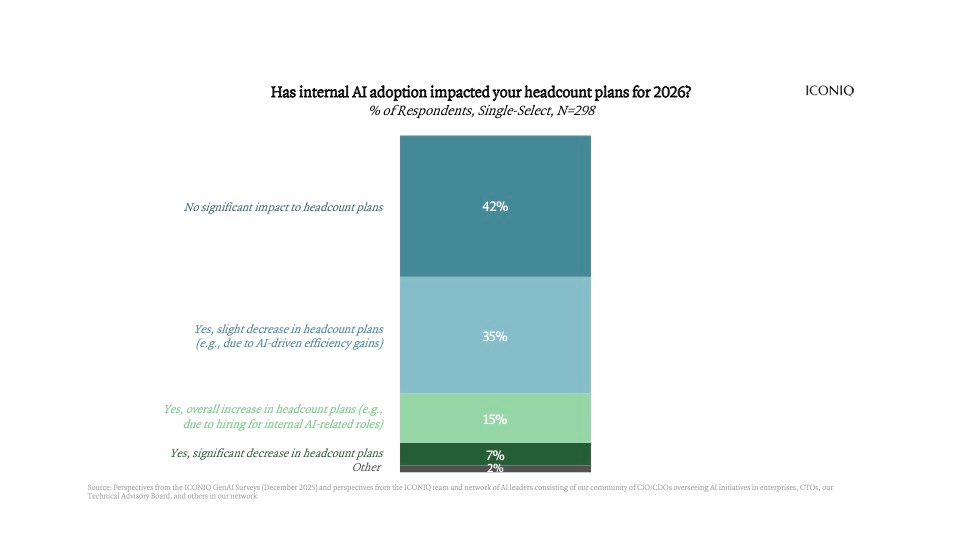

Those same execs are pretty confident that AI tools won’t significantly curb their headcount plans over the next year, with a plurality saying it won’t have a significant impact, and a little over a third saying it could lead to a slight decrease.

Then there’s the 15% who think it will mean a lot more headcount!

We’re skeptical that those saying AI won’t change anything are being honest with themselves.

Even if you’re not laying people off, if AI tools are stretching what you can do with a given role — and you’re expecting to hire AI proficient techies for future openings — that’s still a significant impact. Not a layoff or reduction, per se, but perhaps a choice to hire one more full-time engineer or marketer, when previously you’d hire three.

That adds up, and for talent trying to join these startups, it definitely will feel like impact.

We’ll be curious to see how ICONIQ is able to map these expectations to reality when they check back in with these companies down the road.

“It will surprise no one, nobody at all, that coding and developer-related tools are where companies still see the top use case for AI tools.”

I appreciated the “nobody at all” reiteration :D