Meet The 'Quantified Dog': How Startups Like Fi, Loyal And Ollie Are Pushing Pet Tech Forward

Dogs like Upstarts social media manager Margot will benefit from a new wave of science and deep-tech minded startups focused on keeping them healthier, longer. (Sorry, cats.)

The Upshot

Founder Celine Halioua spends her days working on tech to keep her dog alive. Her startup, Loyal, is deep in the process for the FDA to approve a drug that could extend dogs’ lifespans for two years. If nothing goes wrong, it’ll be available before next summer.

But when it comes to Halioua’s own 12-year-old Rottweiler, Della, Halioua takes an analog approach. She pays for pricey osteoarthritis medicine, and not much else. “I don’t really do anything fancy,” Loyal’s CEO tells Upstarts. “An activity tracker will just tell us that she’s old.”

It’s a similar story at Fi, where founder Jonathan Bensamoun is also working to provide dogs with longer and healthier lives, but through a smart collar that tracks activity level. Fi’s latest model, the Series 3+, could’ve caught a recent ear problem in Bensamoun’s 8-year-old German Shepherd, Thor, as he incessantly itched them at night.

But while Thor’s every movement is monitored, when it comes to his diet, Bensamoun doesn’t use fellow startups like The Farmer’s Dog, opting instead for a custom raw-meat and supplements diet.

There are simply too many startups for any one canine friend, running the gamut of their lives: food and supplements, health monitoring and televet services, even buttons that can help them ‘talk’.

We live this first-hand at Upstarts Media, where, thanks to several tongue-in-cheek social media posts that got scraped by its AI, Google Search might tell you that Upstarts social media is managed by our first employee, Margot.

Margot doesn’t fit the current hustle-first, always-on startup vibe. She keeps irregular hours and naps frequently. Her productivity is severely limited by a lack of thumbs.

Margot is, of course, a dog – specifically, a four-year-old Shepherd and Pitt mix rescue who loves rolling in the grass and harbors a fear of buzzy flies. The Upstarts home office is based near Prospect Park in Brooklyn for her convenience. If we’ve gotten a consistent content request in Upstarts’ first three months, it’s this: more Margot content, please.

We’ve covered a lot of AI news so far at Upstarts – including a big scoop last Friday about a startup led by former OpenAI staff – but Upstarts is focused on the wider startup ecosystem, not just frontier models.

So in honor of Margot, we’re diving into the state-of-play in pet tech, where (surprise!) AI is creeping in, and founders like those at Loyal, Fi and food brand Ollie increasingly identify themselves more with classic tech founders than creators of consumer brands.

“People ask me if we are a marketing company, and I say no, we’re food and science,” says Ollie CEO Nick Stafford, who literally eats his own human-grade dog food for dramatic effect in meetings (chatting over Zoom, Upstarts did not insist upon such a stunt).

At Loyal, Halioua says she identifies more with fellow founders facing regulatory approvals and questions about a heavy need for resources than she does a pet brand. “From a cultural perspective, I consider myself deep tech," she says. “My bros are the space and manufacturing guys.”

More on how startups like Fi, Loyal and Ollie are building – plus data and investor perspective – below.

Presented by Notion.

Perfect meeting notes. Every time. Focus on the conversation while Notion AI captures everything. Get instant summaries, action items, and decisions—all searchable in your workspace. Never lose another insight.

The state of play

If you look at the largest startup funding rounds of all-time in pet tech – broadly defined as including consumer brands like food, services like boarding and grooming, healthcare like pharma and televets, and marketplaces – the boom times were during the SoftBank big-check era and the dog adoption boom of Covid-19 lockdown.

That’s when companies like BarkBox, Chewy, Rover and Wag raised hundreds of millions and pursued IPOs; according to Crunchbase data, only two of the top 20 funding rounds into a pet tech startup over the past decade were closed in 2023 or later: Petvisor, a vet and grooming software platform that raised $100 million that November; and PetScreening, which helps rental properties manage the presence of pets in their buildings, which raised $80 million in March.

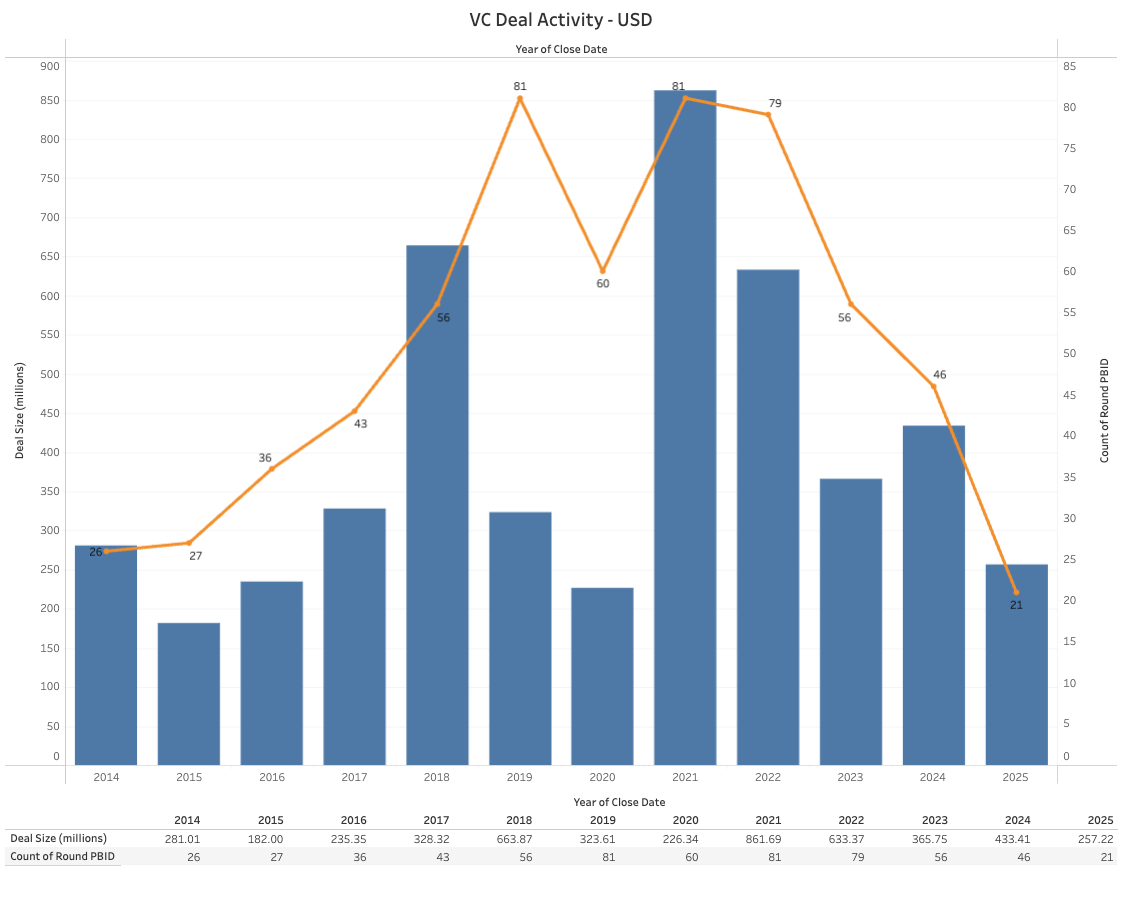

U.S. venture capital activity peaked in 2021 at about $860 million in investment, per PitchBook data; that dropped by half in 2024. “You’ve seen the tourists largely leave,” says Charlie Tapp, a former Mars executive who founded a petcare-focused growth fund, Vetted Capital, last year.

According to Tapp, pet tech remains a bullish category despite a mixed macro-economic backdrop. Customer acquisition costs from changes to Apple’s privacy settings and concerns over supply chains and Trump administration tariffs haven’t made life easier for pet tech companies, he says.

At the same time, consumers are looking to pets for companionship as much as ever, and still willing to spend on furry friends. The category is projected to reach $500 billion globally by 2030, according to a Bloomberg Intelligence report.

“It’s not a recession proof category; you’re definitely seeing a softening in demand,” explains Tapp. “But the ones that are growing are still growing pretty aggressively.”

Among a newer cohort of startups, The Farmer’s Dog is frequently mentioned as an obvious IPO target. Annualized revenue passed $1.2 billion as of February 2024, per reporting by PitchBook News. The startup didn’t respond to an Upstarts interview request.

Future fetching

At Ollie, one of a few brands chasing The Farmer’s Dog, technology built around a pup’s diet is becoming a growing focus. (At Upstarts HQ, Margot is an early adopter and test consumer of Kibbies, a newer startup that produces a mid-priced healthier kibble using invasive carp.)

Most dogs are overweight or obese, says Stafford, Ollie’s CEO; while food is the foundation for improving their health, the company is now layering virtual screenings, via an app, on top. Users submit photos across four different screening types – weight, stool, dental and skin and coat – for vets to review and score. The process is training an AI model to eventually better track changes, and automatically suggest improvements, over time.

For customers, such tech can provide stopgaps between vet visits, and data to share with them. But it’s closely tied to the core product – the food – as better data can drive more purchases.

“We need to start thinking about efficacy, and our tech helps us do that,” Stafford says. “But there are lots of bright, shiny lights, and you have to be careful about having a real focus.”

Fi claims to be the only startup monitoring a dog 24/7. (Mars operates a competitor, Whistle, via a former startup acquisition, that a market report pegs as just ahead in market share.) That produces terabytes of data, which the startup is still working out how to maximize.

“We want to package it to the user to help them make better decisions,” says Bensamoun. “We’re able to train models to detect all of these super granular behaviors.”

Like a number of other startups including Embark, the dog DNA test provider, Fi has gotten into the supplements game, too. Supplements are higher margin, says Tapp, the investor; they’re relatively easy to launch via production partners. Fi offers a few options, from a multi-purpose formula to one for hip and joint health. Unlike Loyal’s drugs, such supplements don’t require FDA approval. But they’re still tested and certified, Bensamoun says. Still, Fi hasn’t figured out how aggressively to market such products. One option could be to recommend a kind of supplement to certain types of dog breeds or users based on their behavior, agnostic to the specific brand. “We don’t want to be too pushy about it,” he claims.

Loyal is walking its own balancing act of how much science it should pack in its messaging, says Halioua. Dog owners tell her that so long as Loyal’s drugs are safe and have plausible benefits, they’ll try them, she says; Loyal’s current study across more than 30 U.S. states is nearly fully enrolled at 1,300 dogs, and will run over the next four years.

“It hurts me personally to make things sound 10% less technical,” she says. “You have to play the game you’re spawned into, then as you get to the next level, you can change the game.”

All these brands are selling to consumers a lot like Margot’s parents: millennials who have made lifestyle choices around their dogs. But their interest also extends to suburban moms who pay up for healthier lifestyles at Whole Foods or Sweetgreen; individuals over the age of 55, for whom a dog can be a main companion, actually spend the most, Ollie’s CEO says.

The pattern reminds us a bit of Eight Sleep, the smart sleep system we wrote about in May. The “humanization” of dogs, coupled with the rise of the quantified self, has given way to a new demographic, argues Fi’s Bensamoun: “Those things collide to become the quantified dog,” he says.

The cat-veat

All this talk about dogs. Does that mean cats remain a final frontier, for another wave of startups to tackle?

Cats are a comparatively smaller market with more finicky and unpredictable end users, says Vetted Capital’s Tapp. Cat-focused products are still gaining more traction and interest, just from a smaller starting point.

A meaningful percentage of families will include both. At Loyal, Halioua rescued a baby kitten, P Terry, that she guesses is now eight or nine months old. But that doesn’t mean Loyal will be releasing drugs for cat longevity anytime soon. A team within the company, jokingly called Disloyal, is tinkering on it. But cats already live a long time, Halioua says; they’re also tougher to consistently dose.

One in five Ollie customers also has a cat. When the startup announced fresh cat food as an April Fool’s Day stunt, many of them got excited. “It was one of the worst things to say that it was actually a joke,” Stafford says. “Cats are there at some point in the future.”

Similar challenges hold back Fi, where Bensamoun says his researchers are closer to figuring out how to track a dog’s heart rate through its collar (a non-trivial tech challenge as its rests on the dog’s fur, not its skin) than they are to shipping hardware small enough for a cat to wear.

People have attached Fi devices to cats in the past, but he wouldn’t recommend it. “I don’t want to design something that looks like a washing machine on its neck,” he says.

Petitioning to change Margot's middle name to Updog.

I’m 100% here for the underrepresented market that helps our furry friends! I grew up with dogs and wish some of this tech existed when they were growing up!