Her Last Startup's Shutdown Went Viral. Now She's Back.

Amanda Peyton's last startup Braid had early traction before faltering. She's back with Pool, a new-look successor that's raised $4.5 million.

The Upshot

For months, founder Amanda Peyton received the question over email and Twitter DMs: Are you going to bring it back?

It’s been two years since Peyton announced that she was shutting down Braid, a fintech startup that helped people to manage money and expenses as groups. At its peak in 2022, Braid had 50,000 users; on some days, it processed more than $100,000 in payments. Investors had poured in about $10 million in funding.

Then Braid was history, its employees gone, its funds paid back to customers. Peyton wrote about what went wrong, and the grim process of winding down the business, in a candid blog post that went viral in tech circles.

But users missed Braid, and let her know. And she missed it, too. So when one of her previous investors, Asylum Ventures partner Nicholas Chirls, checked in last year to see if she might want to try again, Peyton admitted she still felt an itch.

“It’s a very physical feeling,” she tells Upstarts. “But at first, I didn’t know what to do with it.”

There were things she would’ve done differently at Braid: more resilient technological infrastructure, less dependence on one partner bank. The core idea to ‘make fintech multiplayer’, though – that she still believed in. And she wouldn’t be starting from scratch. When Braid’s intellectual property had been put up for auction, she’d won it as the sole bidder.

You can guess where this is going. Exactly two years to the date from when she announced the death of Braid, Peyton is back to announce its rebirth: a new fintech startup, called Pool.

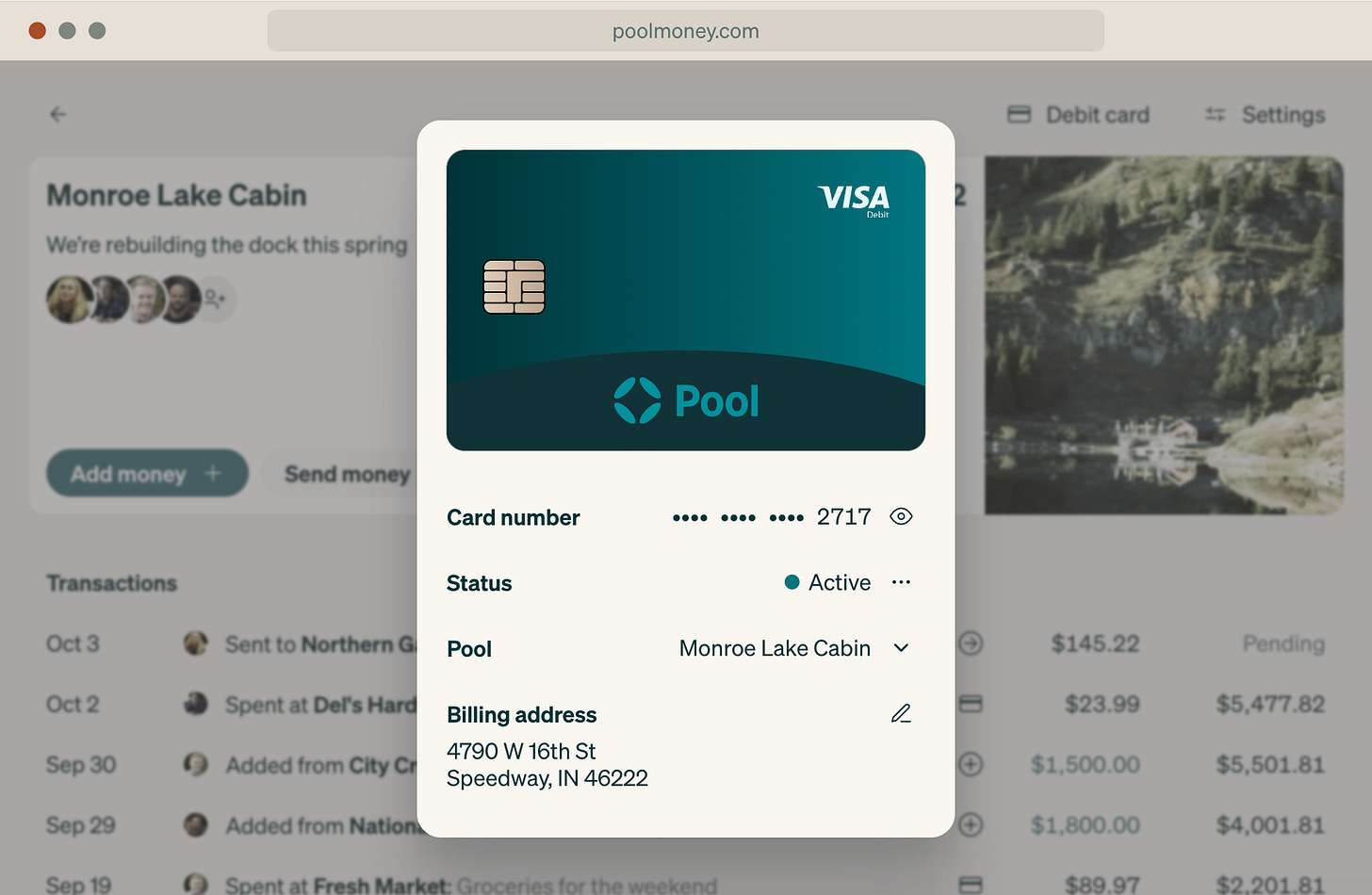

Based in San Francisco, Pool now counts four employees, including technical lead Max Beatty, who previously worked at Block on Cash App Pay. To operate its ‘Pools’ of group financial accounts and issued debit cards, it’s partnered with First Internet Bank and Visa.

It’s not just Peyton who has unfinished business here. About 70% of the $4.5 million in seed stage funding that Pool has raised comes from previous investors in Braid. Chirls of Notation Capital and Asylum Ventures led the round, with participation from investor Coalition Operators, where several partners had been angel investors in Braid, as well as 47th Street and Ritual Capital, among others.

“It’s a much more robust product, but the soul is still the same: the idea that you should be able to share money with anyone,” Peyton says.

Presented by Structify.

Getting answers from your data shouldn’t take three days and two Slack threads.

Structify’s AI agents source, clean, and analyze data from anywhere — Salesforce, Snowflake, spreadsheets, PDFs, internal databases, even the web. Just ask in plain English and get instant answers.

Instead of chasing down messy data, you just ask — and Structify delivers.

No tickets. No technical skills. No waiting.

‘People used this, and they liked it’

What’s the biggest lesson from starting, restarting and then slowly letting go of a business you thought was working?

Upstarts asks Peyton that question. She invokes a quote, attributed to the former U.S. Navy SEAL and leadership speaker Jocko Willink, in response.

“Besides death, all failure is psychological.”

For Peyton, that means a healthy reckoning with the past. She can now talk candidly, with a rueful if at times thin smile, about the experience of launching, pausing operations, then having the rug pulled out right after momentum has returned.

Braid was humming along in 2022 when the heady ‘ZIRP era’ abruptly ended and banks pulled back from fintech deals. Suddenly without its banking partner, Braid had to return funds and pause operations as Peyton scrambled to find a replacement.

By early 2023, she’d found one; users came back, and funds started flowing again. The good vibes lasted a few weeks. Peyton was speaking with potential investors about additional funding when they all stopped responding abruptly: Silicon Valley Bank was facing collapse. This time, Braid wasn’t going to get back up.

Peyton focuses on the positive that people liked her product and have continued to ask for it since.

“In startups you can work for years on stuff that nobody cares about. I’ve built stuff that literally no one has used,” reflects Peyton, who also worked a stint at Google before spending a couple of years attempting to write fiction books. “And so to finally get to this place of, ‘people used this, and they liked it and came back,’ it was a wow feeling.”

One reckoning that has helped Peyton reach a kind of peace about Braid: reviving it after its first setback and required some technical tradeoffs that were always going to pose problems as it scaled. Braid leaned on third parties for much of its tech stack. With Pool, the team is starting simple, with a web app, and focusing more on controlling the software under the hood.

Plunging in

Peyton hopes to seed Pool’s user base with some of the 50,000 customers who were still with Braid to the end, plus about 8,000 more who signed up for updates afterward.

The app is going into alpha testing now, with the hopes of a wider beta test of thousands of users over the next few months.

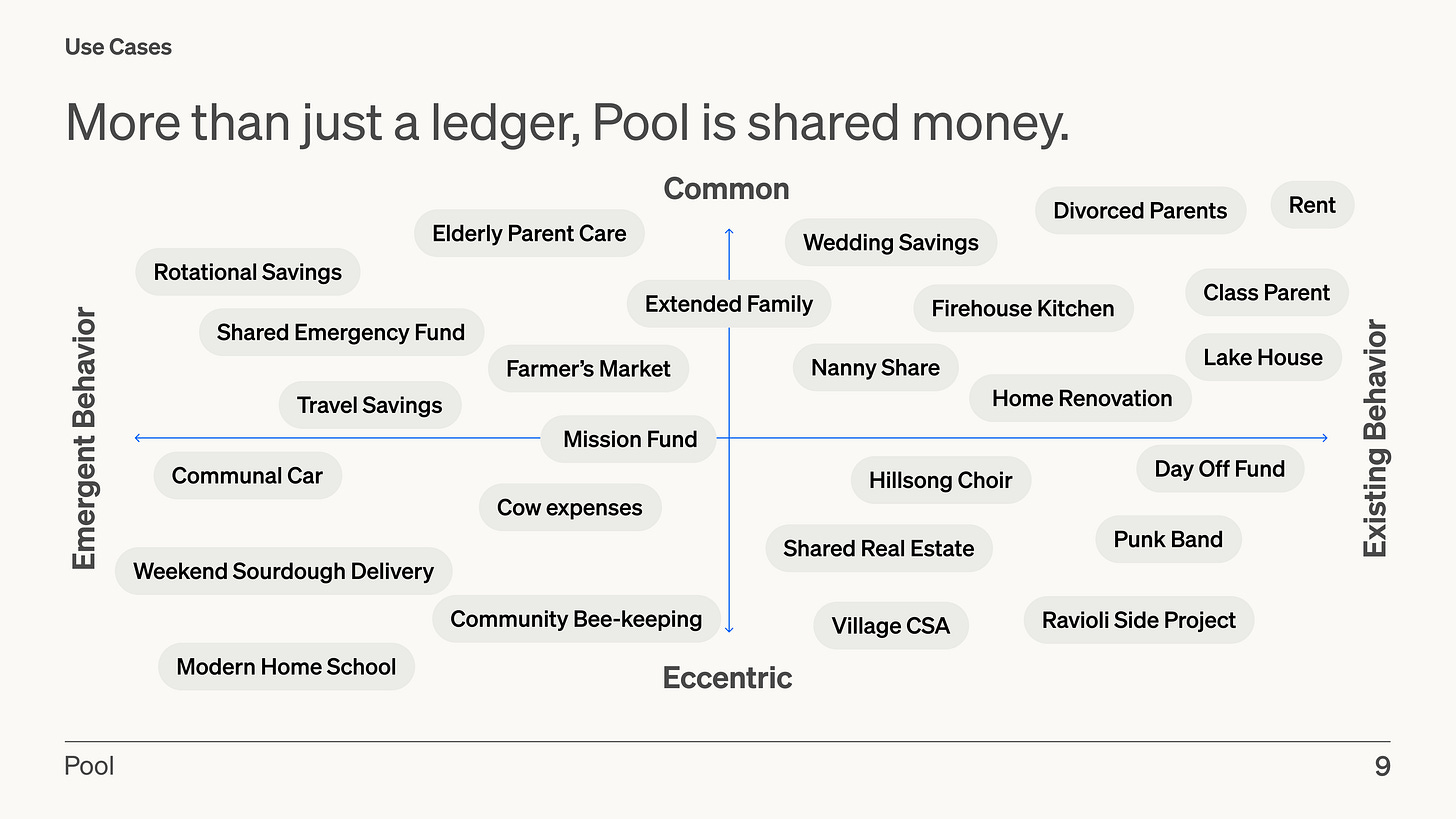

Ideal users of Pool could include PTA groups and college clubs, neighborhood HOAs and other communal groups, from farmers sharing livestock to the camps attending the Burning Man festival.

One key early tester is Gillian Morris, co-founder of Supernuclear, an online publication focused on group and community living. Morris was a power user of Braid, using it to help pay rent, manage a food fund, as well as larger expenditures with housemates.

Since Braid shut down, Morris says she’s tried pretty much every alternative she could find, such as Splitwise and Venmo Groups, without success. “You get used to doing all the work, and then you’re given this solution and you don’t have to do any of it anymore, then all of a sudden you have to start going back to the bad old ways again,” she says.

Morris is eager to use Pool for the transparency it will provide. Pool accounts will offer three tiers of access – admin, spender and viewer – providing visibility for everyone on who is contributing funds and how they’re spending them.

“So many of the disputes or weird feelings that come from group spending start with a sense of, ‘Wait, where’s my money going?’” she says.

While Pool’s use cases don’t seem as wide-ranging as, say, Venmo or Cash App, the startup could benefit from a trend toward consumers turning toward group chats and small group communications to stay in touch, says Coalition partner Ashley Mayer.

For Pool to be successful, Peyton will need to market it to a wider audience than just tech-savvy early adopters, however, meaning that Pool will need to invest in education and marketing for its product.

It will also need to build in as much resiliency with banking partners as possible, to avoid what started Braid’s struggles. That’s where the IP from Braid that Peyton bought back is most helpful, she says: not for the branding or source code, but for the $1 million-plus in compliance documentation and legal work it previously commissioned.

Chirls, the investor who encouraged Peyton to try again, says that even if Pool still faces similar challenges to the last go-around, Peyton is the right entrepreneur to try.

“She just loves the game. She is obsessed with the products that she builds,” he says. “And she’s one of the rare founders that I think actually appreciates the journey, whether it’s high or low.”

I’m very curious to see how this one goes. So many founders, I bet, would die for a chance to try their failed start up all over again. With all the knowledge and experience of mistakes that took down their prior venture.